My Perfect Hotel – Idle Arcade Hybrid casual UA case study

Helping you stay 2.5 steps ahead of the games industry. Don't be too serious, except about UA.

Subscribe to my Brutally Honest newsletter!

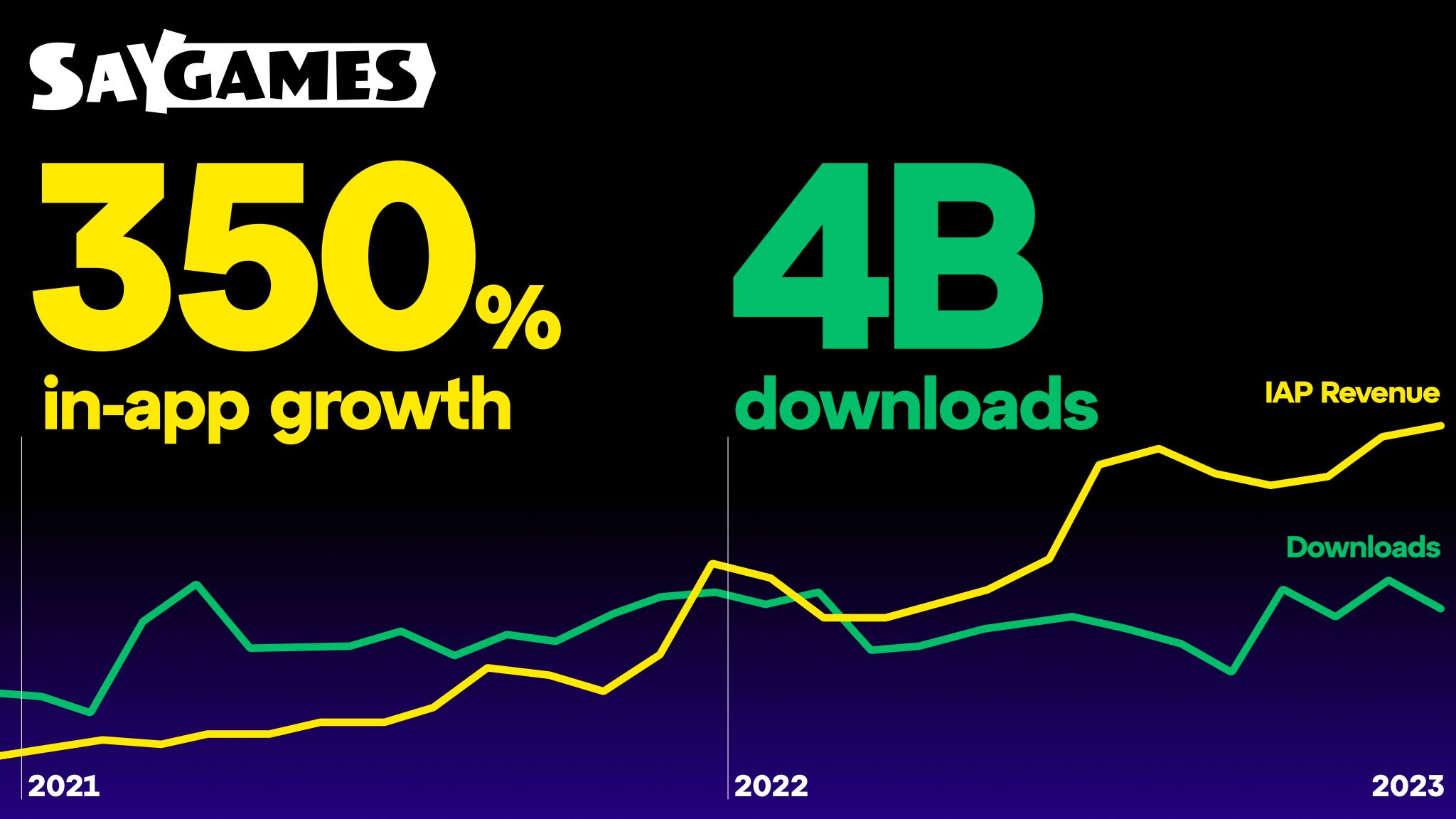

“My Perfect Hotel” has captured the hearts of mobile gamers worldwide, blending the addictive mechanics of arcade, simulation, and idle clicker genres into a seamless hybrid casual experience. My Perfect Hotel game challenges players to manage and expand a bustling hotel complex while offering intuitive gameplay that keeps them hooked. The game My Perfect Hotel launched globally in August 2022 after a soft launch on Android, gaining traction with 3.5 million installs on Google Play and 1.6 million on iOS in the launch month. SayGames’ user acquisition (UA) strategy achieved substantial growth, scaling down in early 2023 and then relaunching with insights from Dreamdale UA campaigns. As a result, the game recorded an impressive 13 million installs within a month, primarily through US and Tier 1 country traffic. Applovin emerged as the largest ad channel, with 50% of ad spend on playables, leveraging MAX and AppDiscovery’s Ad ROAS campaigns to optimize profitability. SayGames adopted a “blended ROAS” approach, combining ad and in-app purchase revenue to maximize returns. They also explored creative UA tactics on Google, running long-form videos to capture YouTube inventory, and diversified through smaller channels like Facebook, TikTok, and Mintegral. The UA team’s combination of innovative creative strategies and effective channel mix has set a high bar in mobile gaming UA management. In this case study, we’ll uncover the secrets behind its meteoric success, including its user acquisition (UA) strategies, ad monetization model featuring 29 ad placements per run, and the hybrid casual framework that has set a new standard in mobile gaming. Whether you’re a game developer, marketer, or an avid gamer, this analysis offers valuable insights into how “My Perfect Hotel” became a standout hit in the rapidly growing $1.4 billion hybrid casual gaming market. Read on to explore how this genre-blending masterpiece is reshaping the mobile gaming landscape.

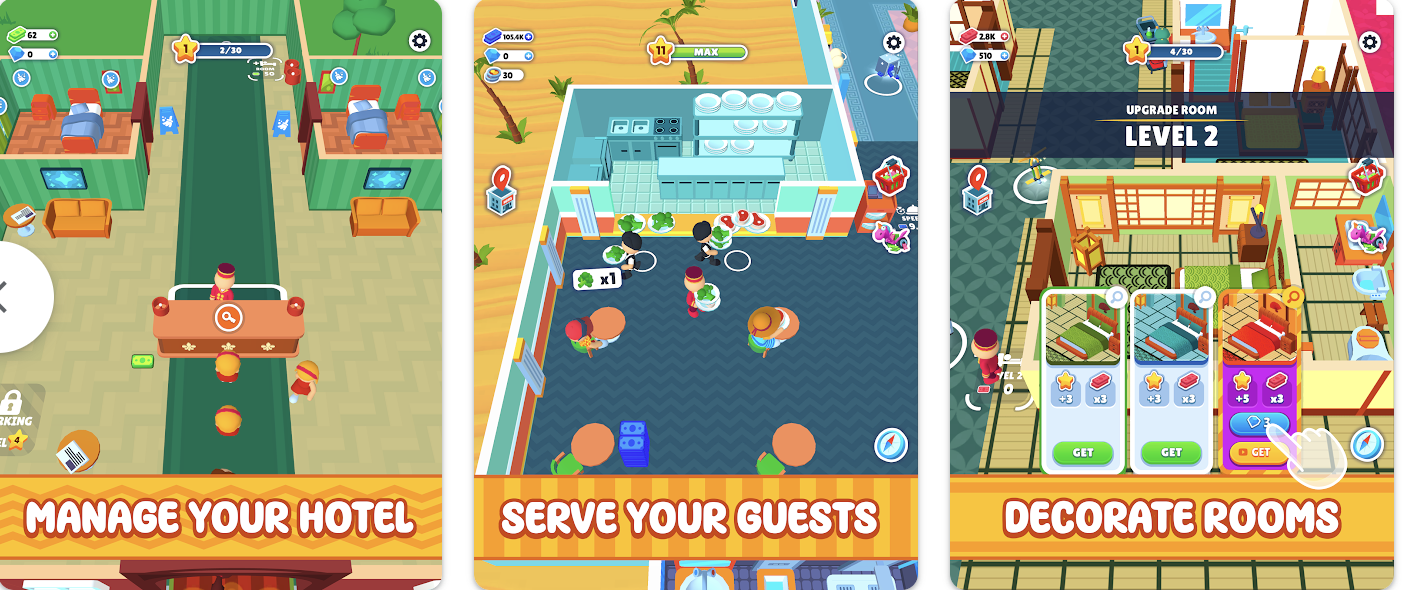

What is MY perfect Hotel?

My perfect hotel is a actually a pretty good & fun game!

My Perfect Hotel is a (hybrid) casual game where you’re in charge of managing a hotel complex where you’ll accommodate more and more guests. Keeping in mind all the tasks that appear throughout the game, you must try to please all the visitors so that they leave satisfied with the facilities.

My Perfect Hotel has 3D graphics from a bird’s eye view. As in most games of this kind, the simple controls are ideal for completing all tasks easily: You just have to tap on the different elements and characters to start the different processes that go on inside the hotel walls.

The process of managing all the accommodations is pretty easy. Firstly, you’ll welcome your guests at the reception desk, and from there, you’ll accompany them throughout their stay to ensure that everything goes smoothly. As you play, you must pay attention to your available budget to add new rooms as you improve the services offered by the resort.

As you welcome dozens of guests each day, filling the available rooms and boosting the income produced by the complex won’t take long. We could check a gameplay footage Jakub recorded during our podcast session:

What User Acquisition Strategy Drove ‘My Perfect Hotel’ to 13 Million Installs?

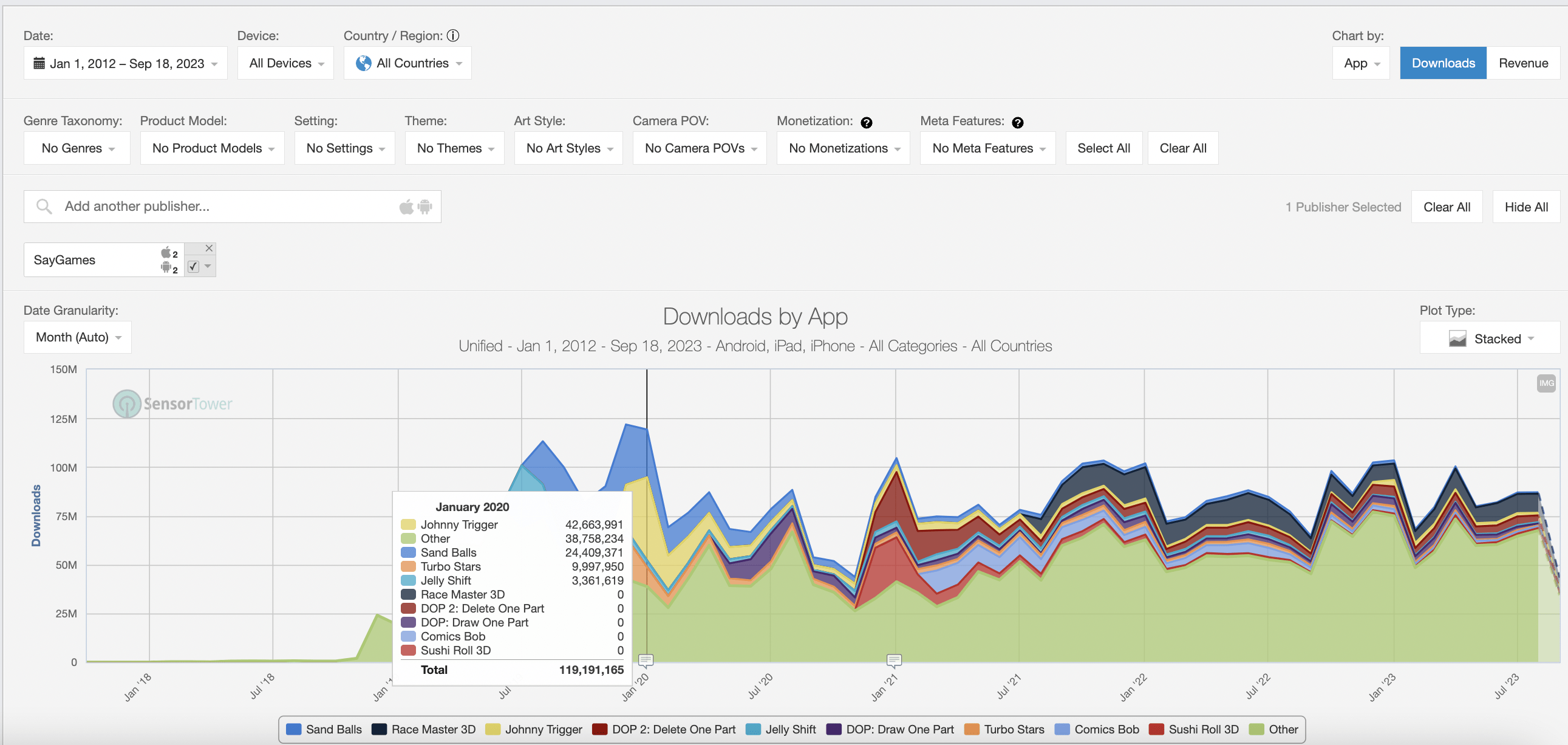

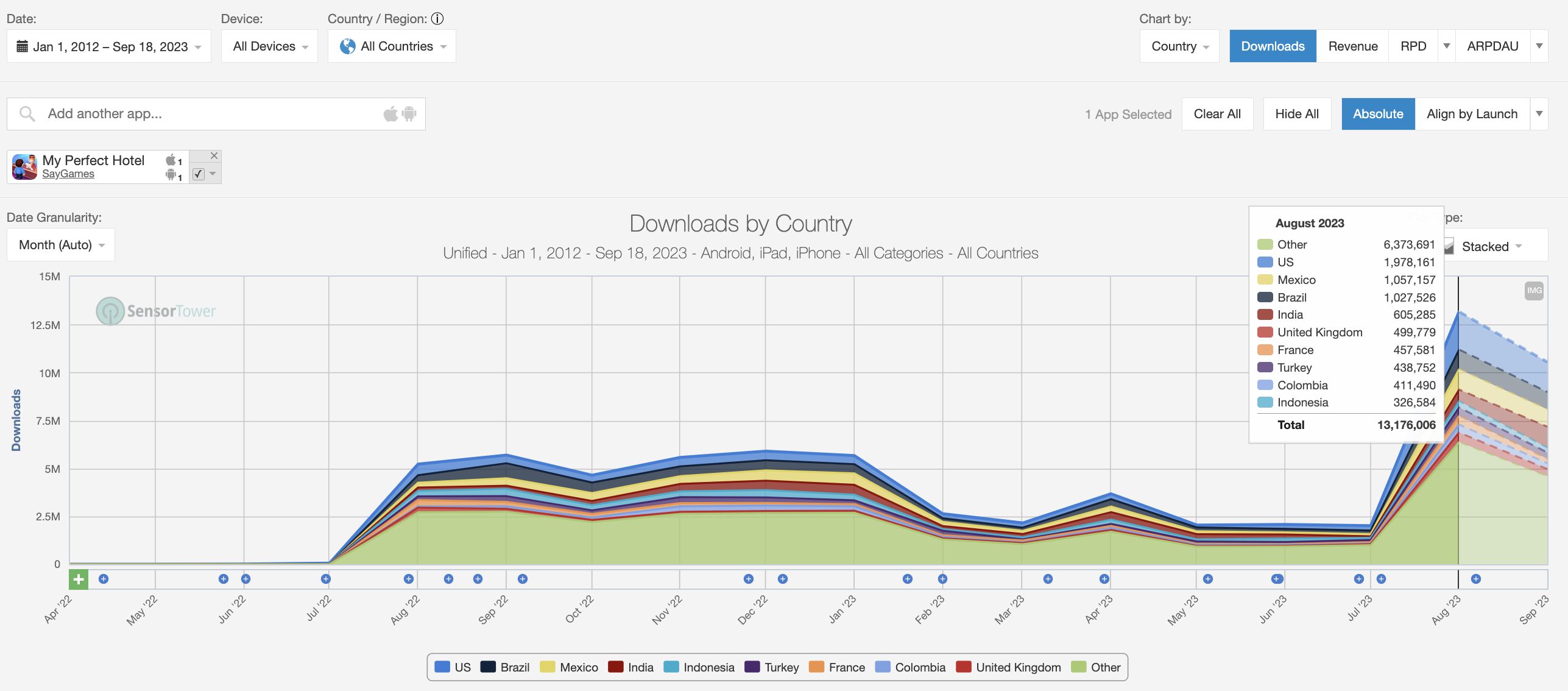

The user acquisition strategy that drove My Perfect Hotel achieved 13 million installs in one month by leveraging a targeted user acquisition (UA) strategy, focusing heavily on high-impact markets like the US and other Tier 1 countries. Interesting is the fact that this game was launched last year on August 22 (no soft-launch on iOS), only on Android.

Let’s talk about the soft launch a little bit. They soft-launched the game on Android in April 2022 and stayed in SL until August when they launched it globally. They used the classic hypercasual approach, US only. Looks like they only published five new versions and the last one in July was the release candidate, which went global.

In August the global launch month, they achieved a nice 3.5 mil installs on GP and 1.6 mil installs on iOS.

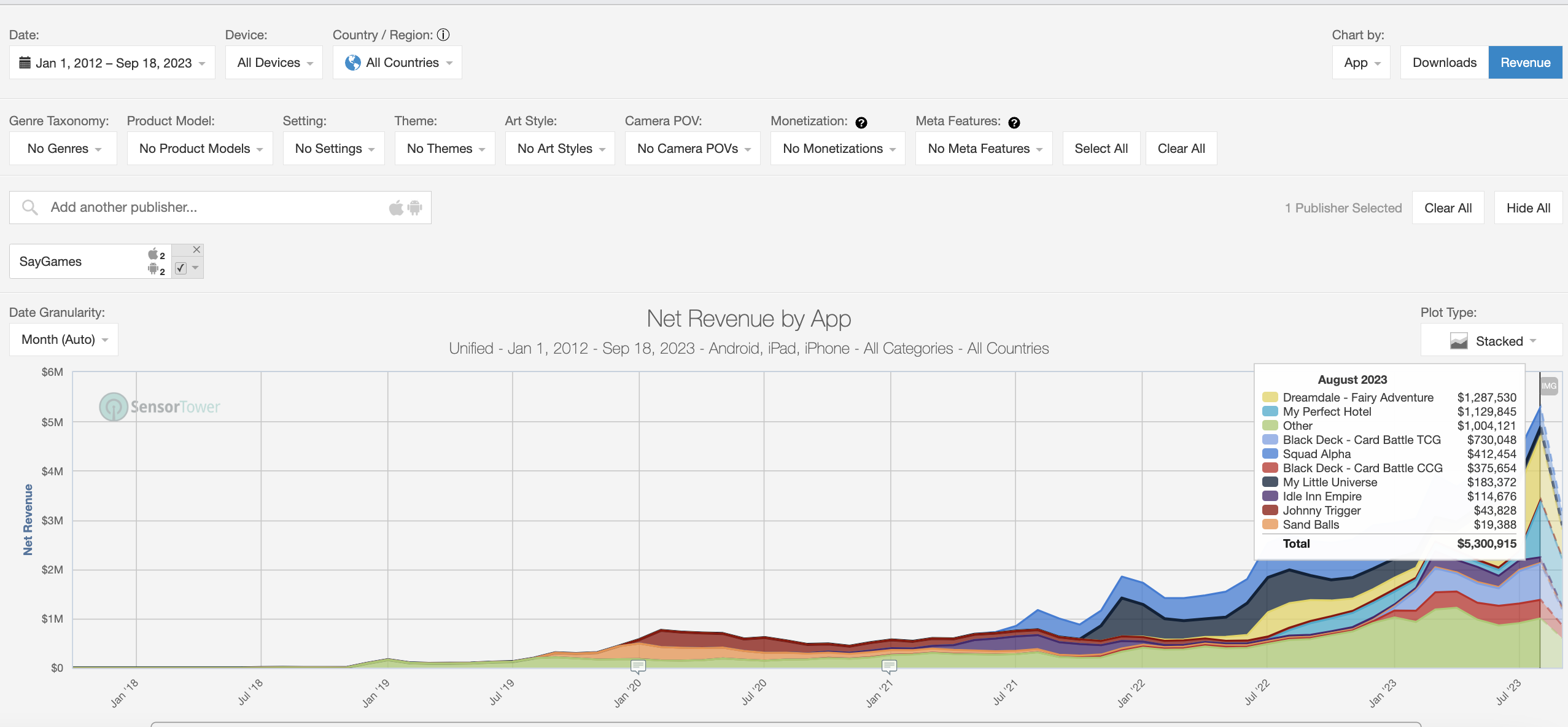

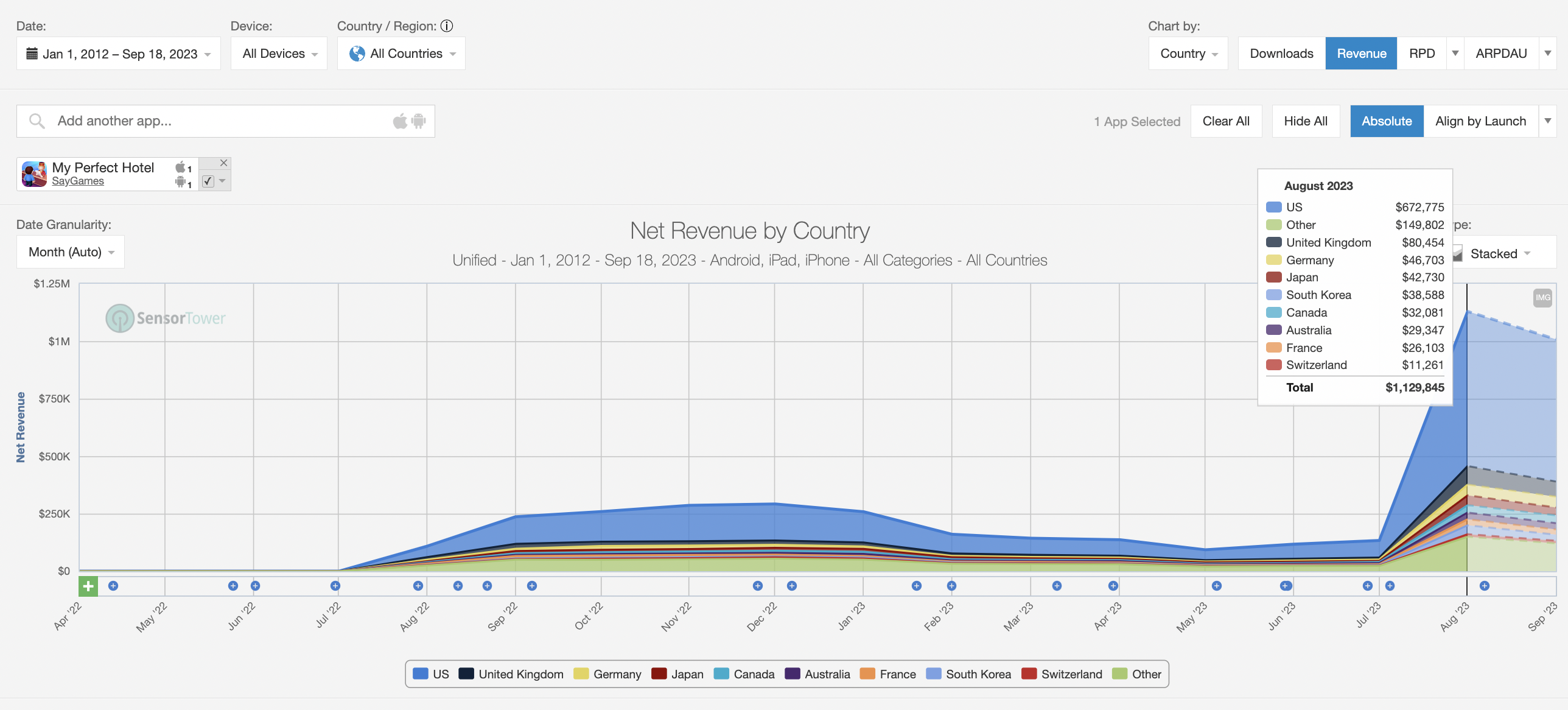

Regarding revenues, $100k in In App Purchases (= don’t forget our sadness multiplier => at least 200k) which increased to $286k resp, around $500k IAP per month with six mil installs IOS + GP (70% GP obviously)

Then, they scaled down in Feb this year until August 2023. At that time SayGames UA team was scaling Dreamdale in April/May, so my assumption would be that they took their UA learnings from this game and applied them to My Perfect Hotel.

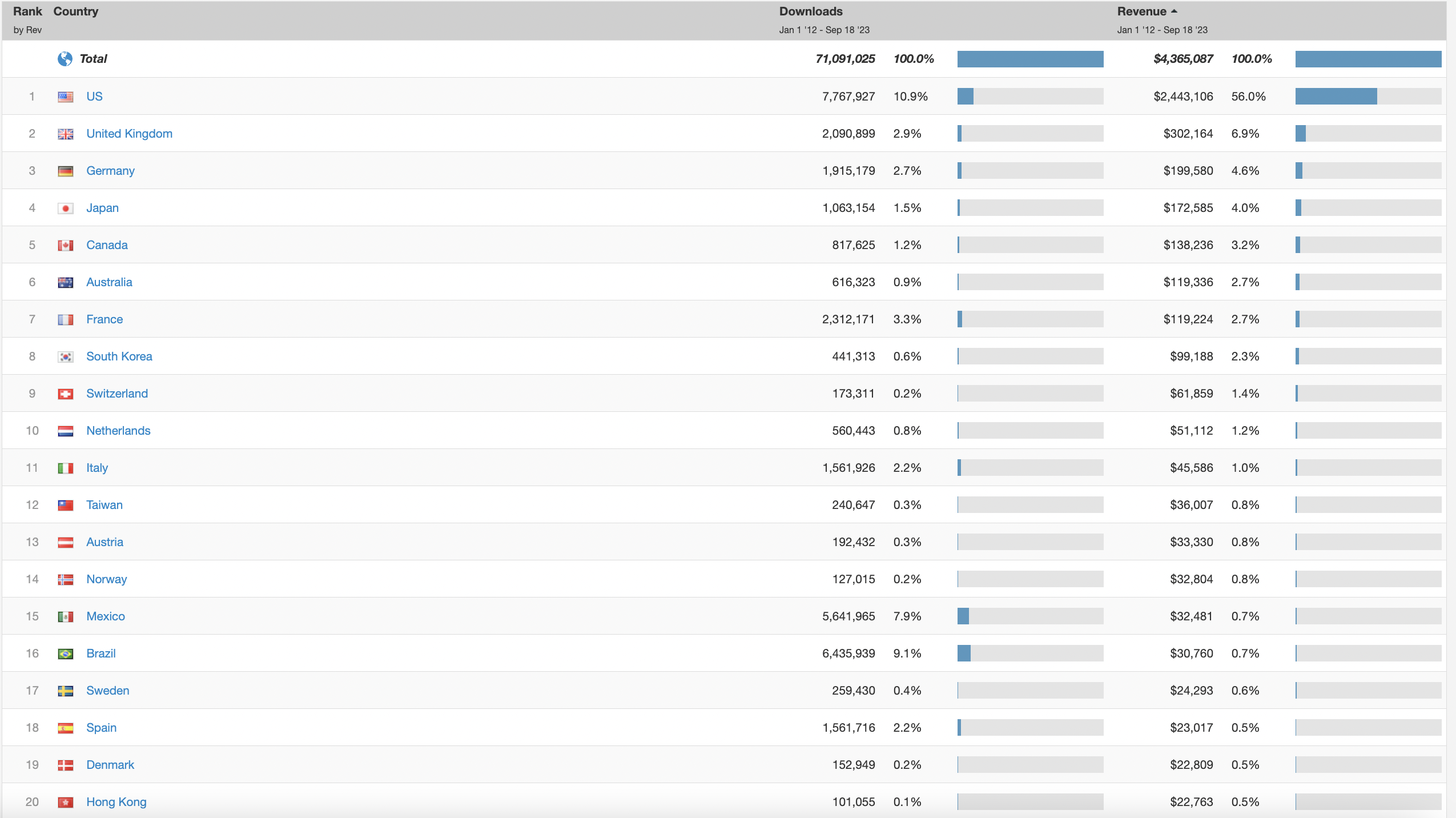

BOOM! My perfect hotel achieved a staggering 13 MILLION installs in 1 month and already has 10 million when writing about it. Mostly buying traffic in the US, but also some other Tier1 countries:

From my point of view, hats off guys. This is a masterclass in scaling. Kudos to the whole SayGames UA team. You are doing an amazing job and making the lives of other UA managers including myself way harder. But hey, that’s the life of a UA person.

How Did ‘My Perfect Hotel’ Use a Diverse Channel Mix to Scale User Acquisition?

My Perfect Hotel’ used a diverse channel mix in following ways :

Applovin is the biggest channel in terms of spending on both iOS and Android.

- Not surprising at all. We talked about this multiple times in the past. Applovin is killing it at the moment on multiple fronts: UA and Admon!

- We can see both videos and playables in their creative mix. But 50% of their overall spend goes to playable on Applovin!

- It’s not a coincidence Applovin is the biggest channel for SayGames.

This is an old case study, but I believe it started a very fruitful cooperation and relationship between companies. Quoting from the case study:

SayGames can now scale user acquisition profitably by moving away from campaigns where bids are optimized based on the performance of each source app to AppDiscovery’s Ad ROAS campaigns. This intelligent user-based bidding system allows advertisers to set their ROAS goal and bid accurately based on the value of each user, regardless of source, to maximize both profit and scale.

Additionally, they also implemented MAX in-app bidding to build a fully automated monetization stack that optimizes for higher returns. MAX and AppDiscovery sync seamlessly, making it possible for SayGames to automate all buying and to optimize for ROAS— with their single largest network partner.

This is very very important. As soon as they implemented MAX, they could scale rapidly all their hypercasual titles thanks to the AdROAS campaigns. But as you know, the hottest UA shit right now is …. the BLENDED ROAS! Which combines Ad revenue and In-app purchase revenue! This is possible only if you have MAX mediation. What types of games now have 50:50 split Ads vs IAPs? Exactly, hybrid casual – My Perfect Hotel!

- Quite big on Google as well! Love the new super-long 7.43 min creative!

My perfect hotel – 7:43 minutes long creative on Google Ads

The creativity of the UA team is quite good. I imagine the conversation:

UA manager: You know what? We should use long-form videos on Google ads to get more YouTube inventory.

Motion designer: What does that mean?

UA: We need 30+ second videos. I will put it on YouTube and add it to our Google campaigns.

Motion designer: Say no more.

UA: Holy shit! 7:43 video? Did you just put all our creatives into one loooooong video?

I have to admit, I am really impressed by their creative concept’s depth. They are constantly bringing new ideas and testing them across the UA channels. Hats off for the combination of scale and creative excellence!

- A bit of Facebook here and there

TikTok

- It looks tiny, one creative that runs for a while.

Mintegral, Unity, Moloco, and the rest

- depends on the tool I use, there are some other channels that are still relevant.

Diversifying the UA portfolio efficiently is not an easy job. Here, we can see a good baseline of plenty of channels, and it looks like they are optimized. One thing that is quite dangerous is that what if, Applovin or Google stop working?

What Role Does LTV and CPI Play in Scaling ‘My Perfect Hotel’ as a Hybrid Casual Game?

The role of LTV and CPI in scaling My perfect Hotel is as followed :

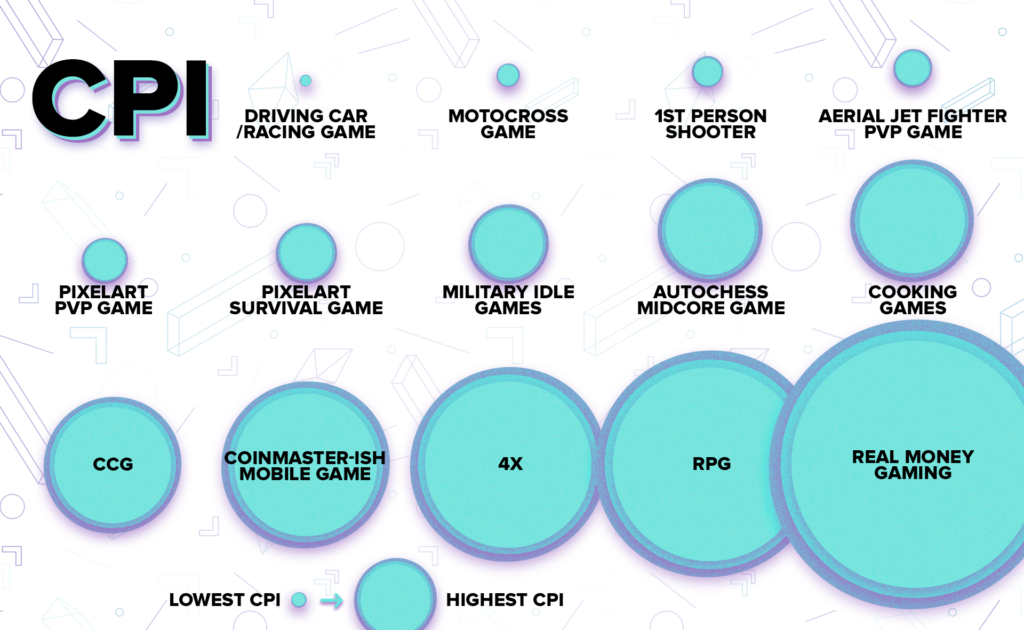

Yes. Again! Scaling a game is not only a function of a killer user acquisition operation. It is also a function of an LTV. You can only scale your budget until the LTV allows you. Eg. If your LTV is $5, you can run profitable campaigns until you hit $4.5 CPI (or any other CPI that you calculate based on your margins). Why does My Perfect Hotel do so well? I worked on some Idle and hypercasual games before.

Generally, they have lower CPIs than other categories. No shit! Finally, hypercasual games drive low CPIs. I was in a lot of discussion about how “fancy or more quality” visual style drives higher IAPs because of the premium feel of the game. The visual style doesn’t have any impact on IAP.

Monetization

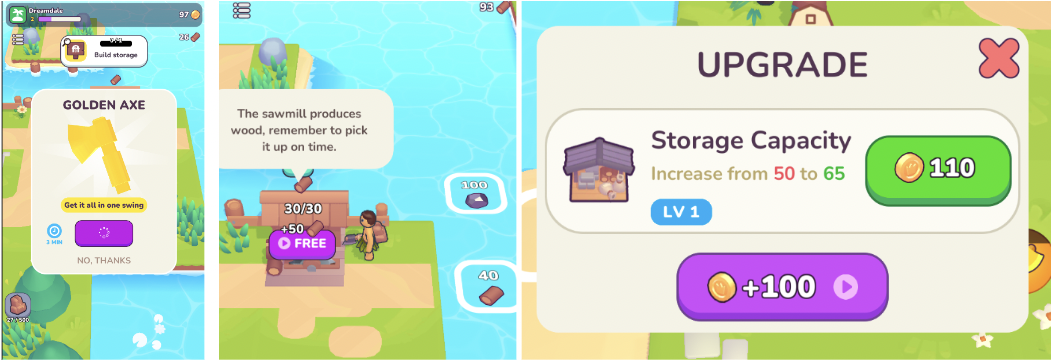

Looking at the previous builds of My Perfect Hotel, you can clearly see some major iterations on the metagame, such as adding specific currencies per each hotel, together with more hotels added. This was not the case before, as this can be seen as a clear push towards hybrid elements.

- Soft currency tied only to one hotel – non-transferable between different hotels

- This was not the case before (major update!)

- Prestige currency from leveling that can be used across other hotels but not in the current version!

Recently we have seen Skip-it’s, the new currency sold directly for money for skipping rewarded videos. My Perfect Hotel directly uses his hard currency instead of Skip-it’s, which then greatly increases the possible spend depth and is also much easier to understand.

There is already another game called King of Fail on SayGames’s account, which clearly continues this trend of the Arcade Idle genre. It is more and more clear that they are successfully building a template for this genre as you can see on the image, which currently puts them in second place, right after Habby in the Hybridcasual race.

What Creative Strategies Drive User Engagement for ‘My Perfect Hotel’?

The creative strategies drived user engagement for My Perfect Hotel’ is as followed :

The creative strategies drived user engagement for My Perfect Hotel’ is as followed :

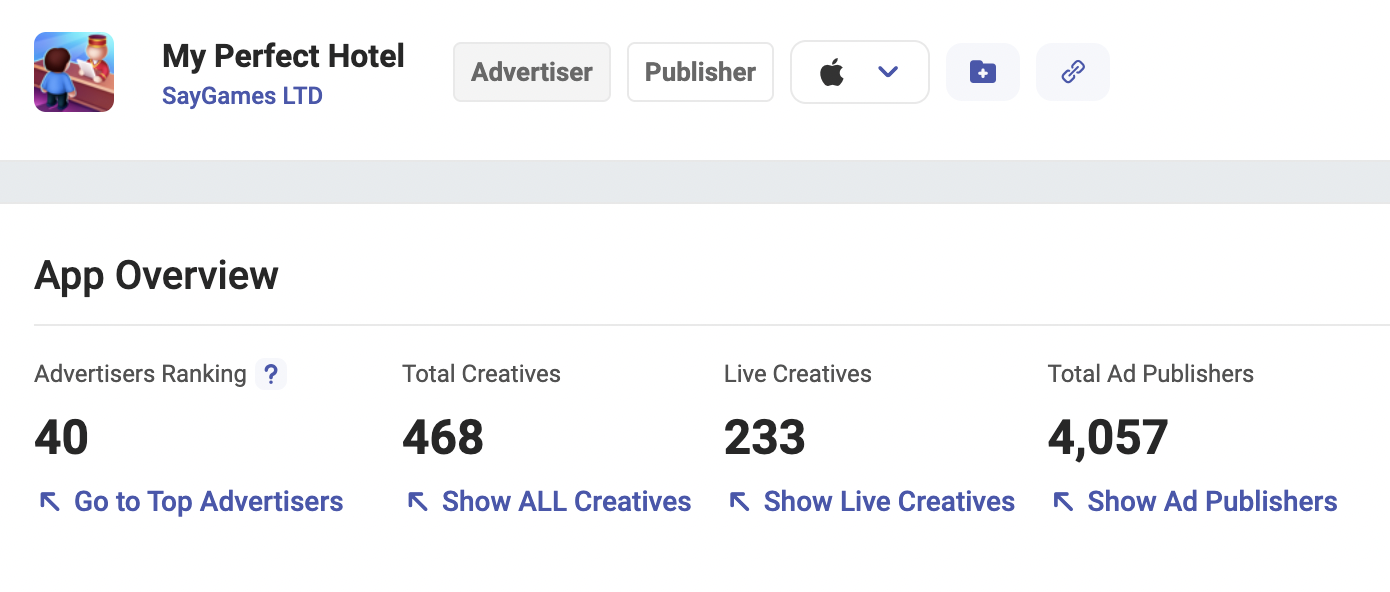

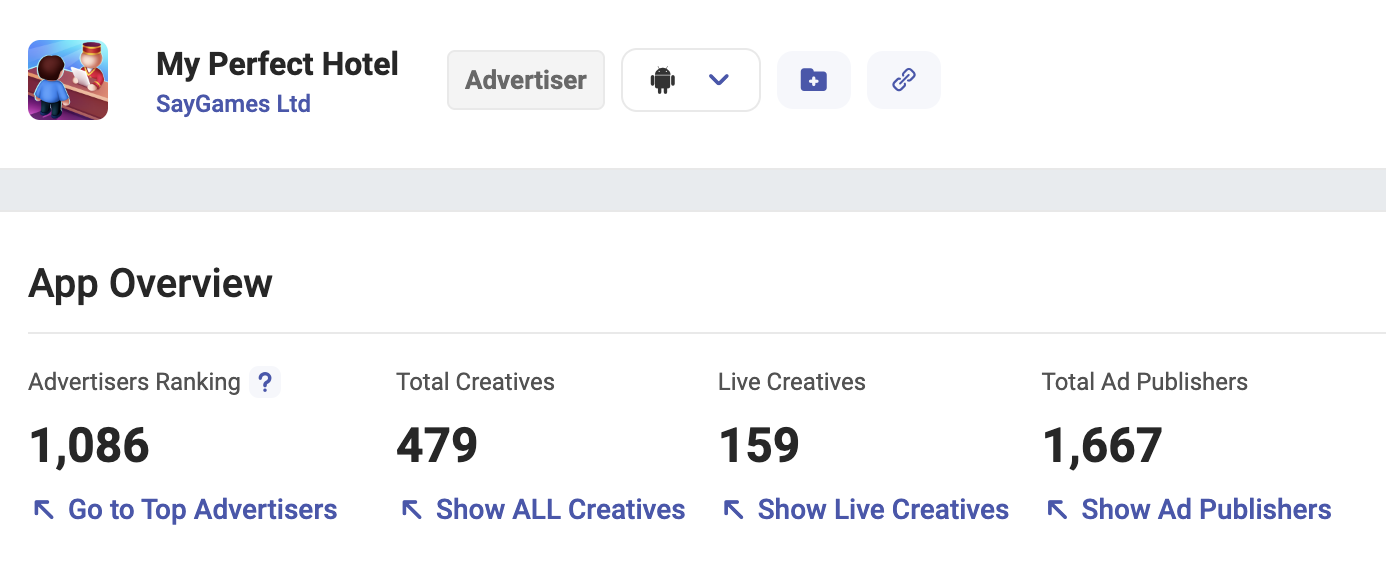

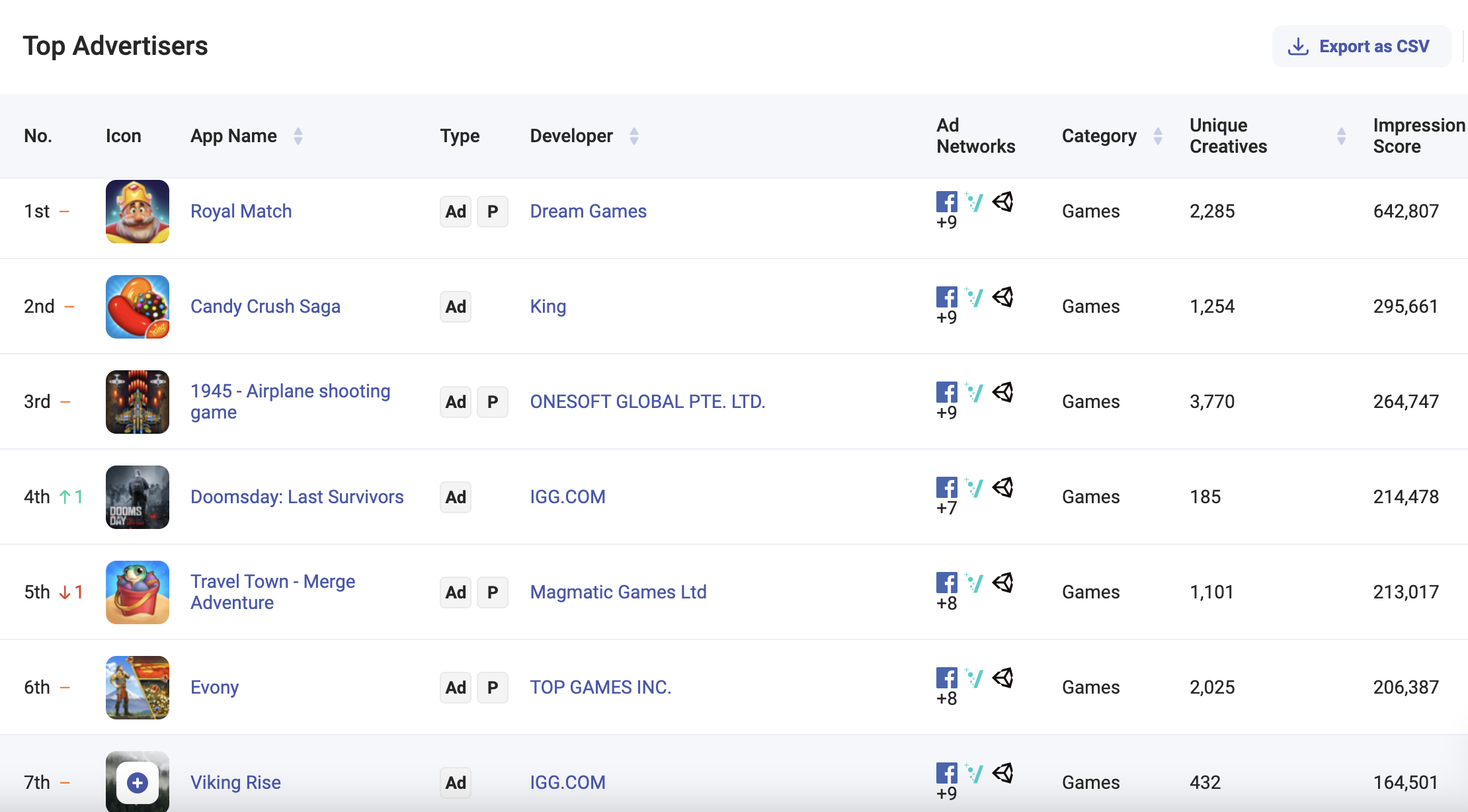

Being No.40 on iOS in advertiser rankings is quite impressive if we look at the top ranks and the names in there:

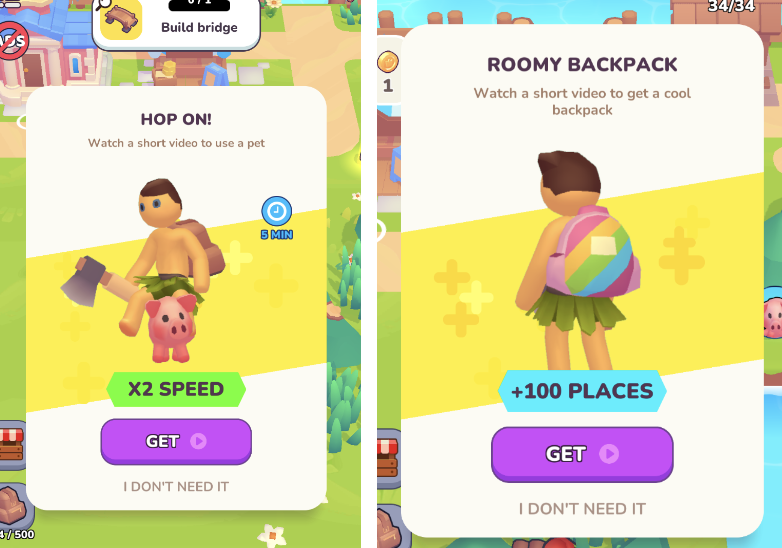

Looking into the Mobile action ads gallery for creative research. These are the types of creatives they run:

- 3D videos & 3D hooks

- altered gameplay

- TikTok AI voice

- hypercasual mechanics (DUUH!)

- few funny hooks

- different visual styles

- classic & simple gameplay

They primarily use gameplay footage, focused on working in the hotel, cleaning and upgrading rooms, getting pillows and well, and helping customers. Quite simple, but efficient.

How Did ‘My Perfect Hotel’ Use Competitor Insights to Develop Successful Playable Ads?

My Perfect Hotel’ used a competitor-focused insights to develop successful playable ads in following ways

- Find a very strong competitor and look into the audience overlap.

- Put a target on their back and assess all their creatives with the most impressions.

- Look for recent winners (last 30 days) and evergreen concepts in the last year.

- Don’t reinvent the wheel.

- Produce 3-5 creatives (could be 1:1 exact copy)

- Iterate winners from there!

Could you guess who did they copy?

What Are the Key Takeaways from ‘My Perfect Hotel’s’ Scaling Strategy?

The key takeaways from ‘My Perfect Hotel’s’ scaling strategy highlight the importance of balancing effective user acquisition (UA) with a robust monetization approach.

- This is a masterclass in scaling. Kudos to the whole SayGames & Redux.games team. The game was live for more than a year and with continuous iteration, they released the version that could support this enormous scale! You need both killer UA & killer monetization strategy. It’s not easy to do it without one or another.

- Amazing creative depth, always testing multiple different concepts. From hypercasual mechanics to altered gameplay and AI voiceover iteration. No UGC bullshit, because UGC in hypercasual games increases the CPI heavily.

Take a look at the full UA, GD & Admon case study below

As always, special thanks go to Mobile action for providing the creative insights! You are awesome!

Subscribe to Brutally Honest Newsletter

Helping you stay 2.5 steps ahead of the games industry. Don't be too serious, except about UA.

Subscribe to my Brutally Honest newsletter!