How to soft launch a mobile game in 2022?

Helping you stay 2.5 steps ahead of the games industry. Don't be too serious, except about UA.

Subscribe to my Brutally Honest newsletter!

Launching a mobile game is an exciting yet challenging journey, and a soft launch in 2022 remains a crucial step for success. A soft launch allows developers to test their game in limited markets, fine-tune gameplay, optimize app store elements like icons and screenshots, and gather valuable user feedback before a global release. By focusing on key performance indicators (KPIs) such as retention rates and player motivation, developers can refine their game for maximum impact. Whether it’s conducting market research, running A/B tests, or choosing the right regions, understanding the pre-soft launch activities and strategies can make all the difference. This guide explores everything you need to know to soft launch your mobile game effectively, ensuring it captures the attention of your target audience and performs seamlessly in a competitive market.Launching a mobile game takes loads of work. After months of development, and production time, the soft launch period comes.

Soft launch will provide you with the opportunity to test your server infrastructure and ensure it will be able to handle the load of a global launch.

For free-to-play games, and especially for those with in-app purchases, it is important to determine how well the game will do globally and if it has a good retention profile and monetisation mechanics.

Simply put, this will tell you if your game will be profitable and you should aim for a global launch or simply kill it.

If you plan on looking for a publisher for your game, you should be aware that many publishers will look for some soft launch data before committing to any sort of monetary guarantee. Therefore, doing your own soft launch is highly recommended, as it will put you in a much better position during negotiations.

In this post, I’ll be covering a few items that I believe are MUSTS for anyone in, or about to enter, soft launch.

But before we start, there is something you can do even before soft launching your mobile game.

What are the key steps to prepare for a mobile game soft launch?

Market research

In my humble opinion, the most important part of game development. Market research is the process of looking at the game market through numbers, facts and opinions. It’s about finding the equilibrium between what the audience wants, what your teams want to build and what your teams actually can build, scale and operate. This step will give you some ideas about what you can expect while making and operating your game. Thorough market research should also help you to identify the challenges you’ll face in production and marketing allowing you to mitigate them in advance.

Researching key players in your game’s genre can give you some great insights into what your target audience values in a game. You need to do some homework and answer these questions about the games and the players in the genre you’re targeting:

- How are other games named? Are they memorable?

- How does an IP fit into the game genre?

- For example, a game that is based on a well-known IP ( such as Disney, Harry Potter, Marvel etc.) doesn’t guarantee success if game mechanics is poorly implemented or the game is lacking well-built progression elements

- e.g. Disney IP in the RPG game won’t probably match the expectations of the classic RPG target audience. Looking at the recent launches of Disney Sorcerer’s Arena, Looney Tunes™ World of Mayhem – Action RPG, etc.

- Which keywords are they ranking high for?

- Who wants to play this kind of game?

- What is the size of the potential audience?

- Does this audience have significant disposable income?

- What is the potential RPI? (Revenue per install)

- Are players competitive or social?

Doing an internal analysis could prove to be very useful in getting your game in front of the right audience. Let’s talk more about how to do it.

Target audience

The obvious strategy for your mobile game is, of course, to try to make a game that appeals to your target audience and at the same time stands out from the crowd of similar games. But how do you know, who exactly your target audience is and what it wants?

The usual way to identify your game’s target audience is to use game categories. If you are making an RPG game, you can check out the best performing RPG games in your market, analyse them and try to learn their strengths and weaknesses. It’s natural because you aim to focus on RPG-enthusiasts. Well, you can surely have some success with that logic, but you are also severely narrowing your view and creating unnecessary blind spots. And these blind spots can cost you a lot of potential gamers and daily revenue. Games usually focus on primary and secondary target audiences.

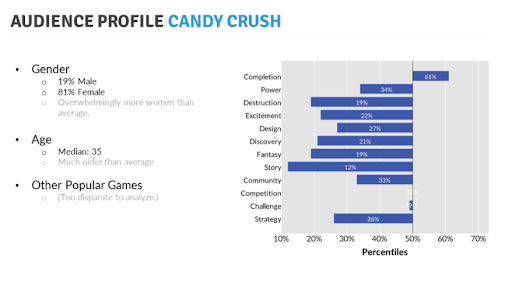

For example Candy Crush Saga – Candy Crush is a casual browser/mobile Match 3 game. The audience of Candy Crush consists mostly of female gamers and also much older gamers. These gamers focus on Completion (collecting and finishing everything) and almost every other motivation factor is low. So the primary focus is on the middle-aged female audience that is interested in match-3 genre and cares mostly about achievement over all other aspects of the game, but also aim to entertain male audiences with hard puzzles in the later stage of the game.

Determining the target audience

Determining the target audience is key to reaching the loyal and high-profit players, in order to ensure the ROI (return on investment). To effectively determine the game’s target audience, game developers should consider the three main general aspects of target audience grouping: demographics, psychographics and motivation.

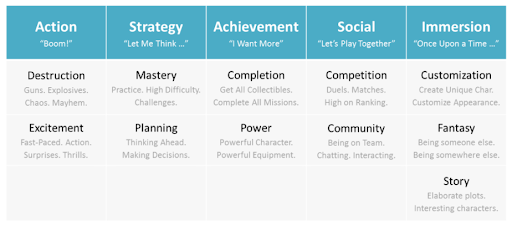

Players motivation information

Players play mobile games for different reasons. Most gamers, from their own gameplay experiences and playing with others online, have some taxonomy of some of these gameplay preferences. Over the past two decades, academic researchers and game developers have proposed many models and frameworks to codify these differences. There is certainly no shortage of models that describe players (from Bartle’s well-known Player Types to LeBlanc’s Aesthetics, from Lazzaro’s Fun Types to Sherry’s Gaming Uses & Gratifications)

Despite a large number of models companies use, there has been a relative lack of quantitative data backing up most of those models. From a statistical point of view, the following issues have typically not been addressed quantitatively. Quantic Foundry developed, based on the motivation definitions or existing survey scales, brainstormed a few items for each of the motivations. For example, for Challenge: “take the time to practice and master a game” and “play the game at the highest difficulty level”.

A basic example of a player profile is: LAURA, a female aged 35–40 who lives in the US and has a university-level education (demographic), is a sociable extrovert from a top-middle economic class and lives an active lifestyle, plays puzzles & adventure games (psychographic), lives in Nashville, Tennessee (geographic) and makes small and frequent purchases without considering the brand (behavioural). She desires to complete every mission, get every collectible, and discover hidden things.

There are many methods of demographic, psychographic, geographic and behavioural data collection. There are quantitative methods, statistical processes such as surveys and questionnaires, and qualitative methods, being in-depth approaches, such as focus groups or comprehensive interviews. There are several companies that specialise in target audience research – e.g. above-mentioned Quantic Foundry or Solten.

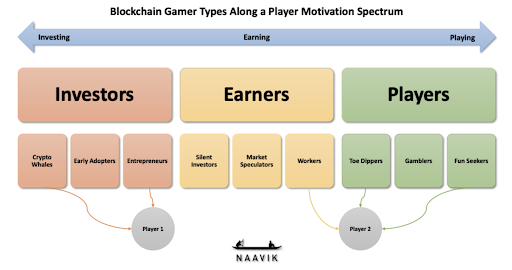

Let’s not forget the new kid on the block(chain). We need to look at gamers with different lenses when talking about blockchain games. Friends at Naavik have looked at it already.

The nine blockchain gamer types showcased above are a function of a player’s driving motivations to engage with blockchain games.

Concept testing

Most developers know how to test concepts and do this early on to mitigate the risk of the investment. Since concept testing is extremely cost-effective, there is no reason for other developers not to do it as well. The app store platforms are becoming more competitive every day. The best way to gain an advantage in this saturated space is to identify more accurately which concepts will appeal to the widest audience. Concept testing helps you make these important product development decisions using concrete data, and it plays a critical role in revealing how people make their own decisions and which messages convince them to install.

The other benefit of concept testing is its flexibility. To enhance your learnings, you can use surveys. To obtain player feedback, you can create a redirect on the test app store page that directs people to a survey. These questions can cover game mechanics, characters, feature set, core loop, monetisation, spending behaviour, how often players play games and more. These survey questions are invaluable to:

- Find the most loved (or hated) characters

- Identify aspects or features that could drive the best monetization and return on investment

- Pinpoint the most liked (or disliked) features

That way, you can ensure every detail is perfect before making it available to your target audience.

The step-by-step guide on how to do marketability tests can be found here!

How to soft launch a mobile game successfully?

Soft launching a mobile game successfully requires strategic planning and execution to refine gameplay, optimize user experience, and validate marketing strategies. Follow these key steps:

What is the point of releasing a new game or app to a restricted audience market in advance of a full launch?

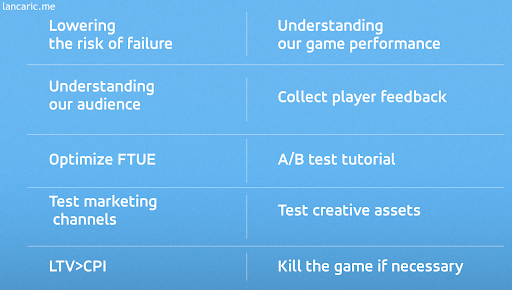

A successful soft launch is the best way to optimise your mobile game for global launch. The Build, measure & Learn loop is a product development principle that emphasises speed of iteration as a key component in product development.

When using this principle, the goal is to release your game to market as soon as possible, measure its performance and then iterate based on user data, repeating the loop as often as required or possible

Soft launch stages

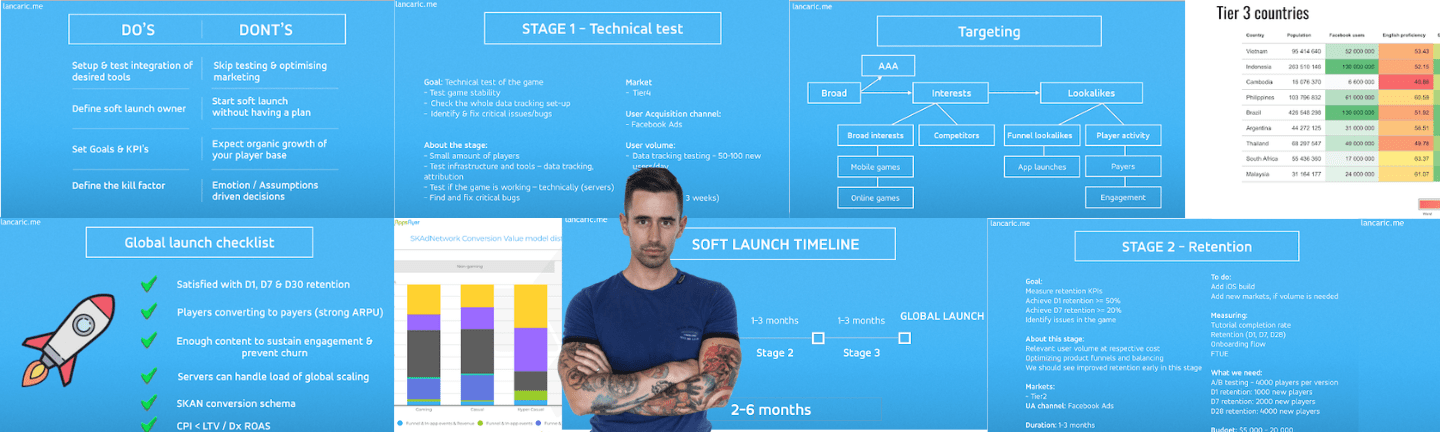

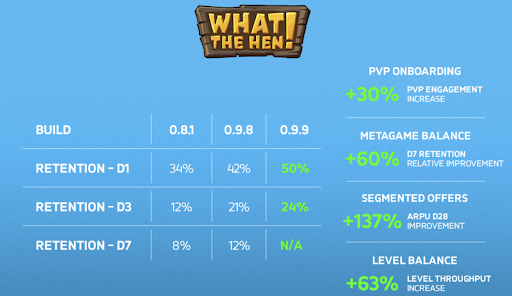

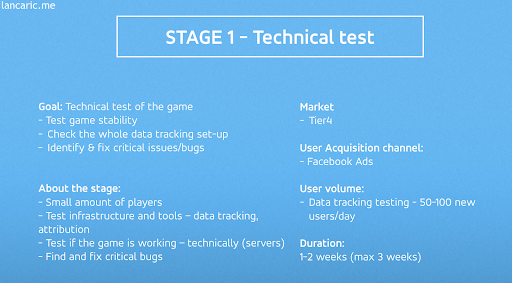

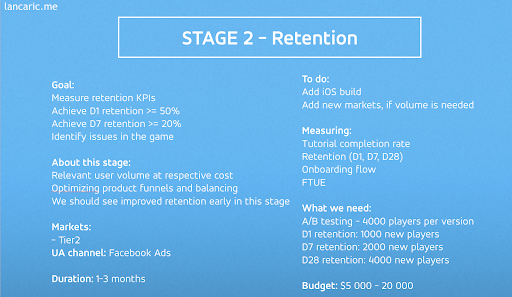

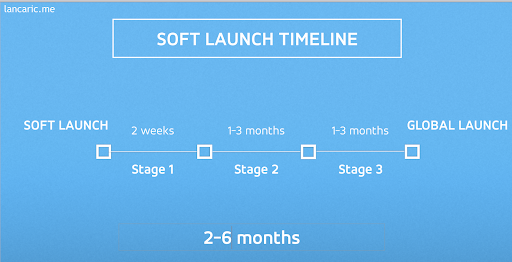

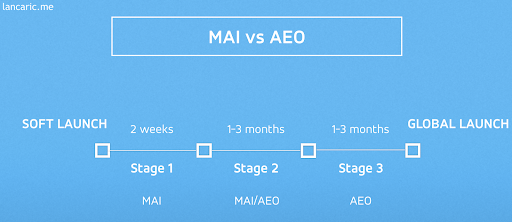

I like to divide soft launch into three stages – Technical, Retention, Monetisation. Each stage serves a different purpose and we measure different KPIs.

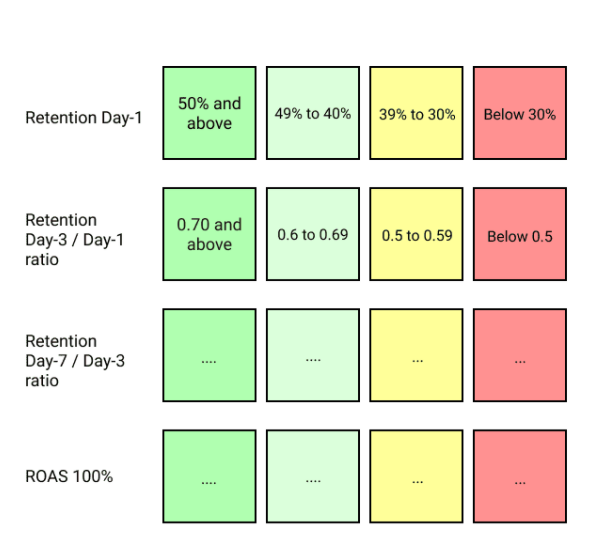

While in the Technical stage, we are mostly focusing on data health, crash rate and tracking in general, in the Retention stage we measure D1, D3, D7 Retention (duh!), FTUE, tutorial completion rate and much more..

Game developers are obsessed with achieving the highest D1 retention numbers they can, but D1 is not the holy grail. I’ve seen games with D1 retention around 25% still being able to generate 2 million EUR a month. The magic was behind really good D60 retention, which was 6-8%. Therefore, it is absolutely crucial to focus on the ratio between D1, D3 and D7. Joakim described multiple scenarios here, definitely check them out.

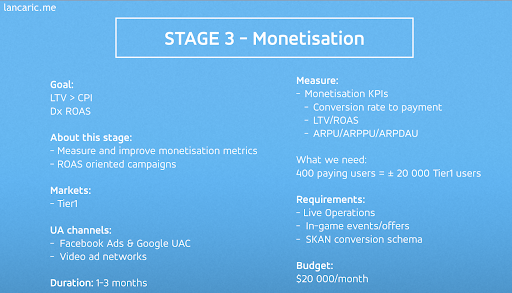

But enough about retention, let’s focus on the monetisation stage where the fun starts. Measuring ARPU, conversion to payment and Dx ROAS require running purchase (ROAS) oriented campaigns – AEO/VO on Facebook or tCPA/tROAS on Google Ads.

Let’s not forget about the Ad monetisation. In this stage, you should already have cracked the rewarded video ad placement. Now you are playing around with setting up waterfalls and combining floors with bidders.

If you’re not familiar with how to manage an ad waterfall or the mediation set up at this stage I would recommend relying solely on Unity ads. Once you’ve set up ads, the North Star KPI you should track at this stage is Impression per DAU. Generally, an IMP/DAU above 4.0 means the Rewarded Video (RV) placements you’ve placed in the game will impact your UA efforts in a meaningful way. If you’re coming in below this number you either have to change the RV placements, RV rewards or accept that the Ad revenue will not make up a significant portion of your revenue. If you’re only using one ad partner at this stage, it is a good general rule of thumb that once you add a mediation platform you’ll increase your ad revenue by 100%. Then with a proper mediation setup you’ll further increase the ad revenue by another 25%.

Soft launch timeline

How long should we be in the soft launch? There is no correct answer to this. The goal of soft launch is not to be in a “tweaking mode” forever and step by step improve the game. Not every time it’s possible.

How long your game can stay in the soft launch is influenced by multiple variables:

- CPI vs LTV or Dx ROAS goal hit

- Retention KPIs

- Monetisation KPIs

- Money in the bank account

- Kill the game, save your company

Soft launch countries

In order to discover what country could be the best fit for your mobile game, what are the criteria to look for?

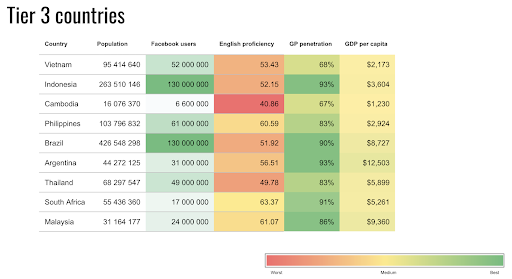

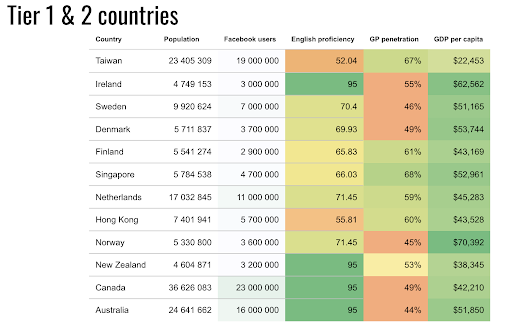

There is a wide range of different countries that seem quite suitable for a soft launch. It is always important to think about your game target audience when picking the most suitable GEOs.

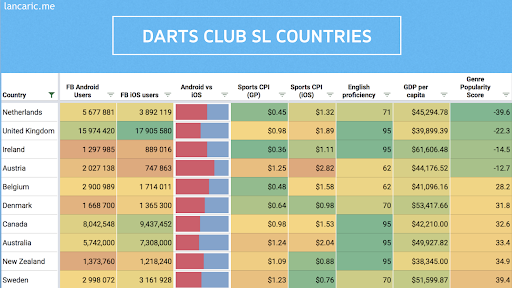

My favourite country for midcore games (male oriented) is Poland, because it has really big android penetration, high English proficiency and a big male audience. But if I soft launched a female oriented game, I would most probably skip Poland as a GEO. This is how we did it for Darts Club:

Looking at multiple things like Facebook audience, potential CPI, english proficiency and we did some calculations on the genre popularity. This was all manual work, but I’ve done it for you for some countries here:

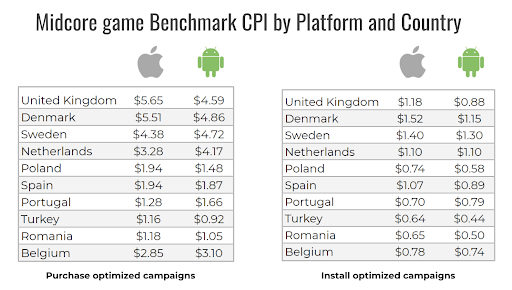

Most frequent question in soft launching: Is my CPI good? How does it compare to other games? While there was a Chartboost CPI benchmarks website, that is really obsolete and far from the truth. Here are again some examples I can share to get the idea about how CPIs vary in between GEOs and different optimizations as well:

Google Beta testing in Soft launch

Beta program is gaining popularity amongst game developers, Google has done a pretty good job of giving game publishers the tools that they need to make their games the best they can be. The benefits of beta testing are obvious, you can test your game with specific groups or open your test to Google Play users. Available testing options include Internal testing, available only to people inside of your organisation; Closed testing, available to a larger set of testers but not publicly available; and Open testing, which will make pre-release versions of your app available on the Google Play store. Games in the beta testing program don’t get reviews on the store which can be beneficial when something really breaks. All in all, a beta testing program is the way to go in soft launch since you can do the same activities as if your game was live in a limited amount of GEOs.

App Store Optimisation

Even before the IDFA shenanigans happened, game developers launched their games in Soft launch on Android. Android was always the go-to platform thanks to the fast review processes and tools available in the developers console.

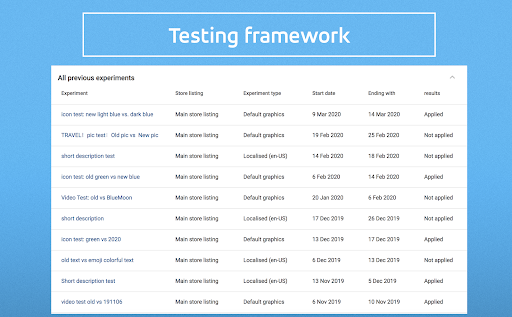

The algorithm in app stores always looks for keywords, a well-written description, and optimised titles. Soft launch is the best time to start with keyword research and optimise your app store visuals. Focus on Icon, screenshot and feature image and test these at least once, but ideally multiple times to get higher chances of improving conversion rates and therefore decrease the CPIs.

ASO should be a crucial part of your user acquisition strategy, so it’s important to get this right early on.

Soft launch is the stage where you can make sure you’ve got the most appealing app store pages possible.

Analytics

Game developers should approach soft launch with an open mind. During any soft launch, it’s vital that personal bias is removed and data alone is used to determine what is and isn’t working. We should be making data-driven decisions, but we all know that people make mistakes and let their emotions get in the way.

Soft launch is the time when you work with your data team to set up UA dashboards, integrate tools, monitor KPIs and provide enough players for A/B testing. In the monetisation stage, UA and data teams work hand in hand to create LTV predictions based on the acquired cohorts. This is also why I suggest staying in soft launch for around six months, so you have enough data to build those LTV models.

iOS14+

There’s no doubt that Apple’s iOS 14+ has introduced important measures to safeguard user privacy. But it has also created significant challenges for marketers who have had to adapt to a completely new way of measuring UA campaigns.

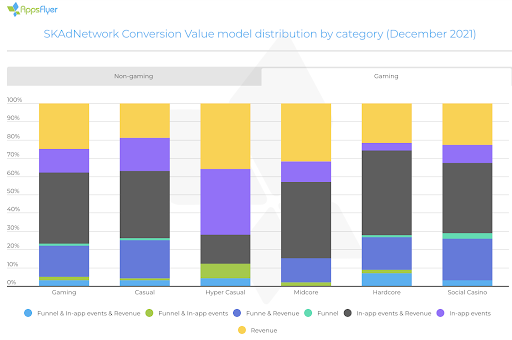

Before iOS 14, marketers could measure in-depth and at length to determine user/campaign value. But in Apple’s SKAdNetwork, data is far less in-depth and at length…You get 64 combinations from 6 bits to map post-install activity and a few days at best of activity data.

The majority of games are driven by revenue conversion schema, with 84% of games utilising revenue configurations.

Some game genres have a lower time to first purchase – particularly casual games – compared to midcore or 4X strategy. It is absolutely crucial for UA teams to work alongside product/game teams to ensure the game can capture as many purchases as possible in the first 24h (without jeopardising the game economy). This will enable UA managers to scale iOS campaigns.

User Acquisition strategy

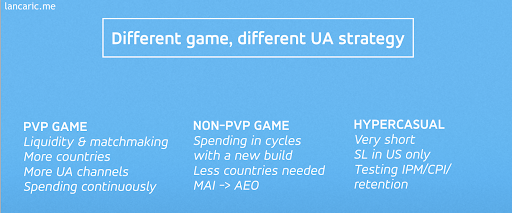

My go-to UA channel in the soft launch was (and still is) Facebook. Given the recent quality fluctuations, I started introducing Google UAC and Unity ads very early on in the retention stage. How should your strategy differ when you have a PVP game vs a non-PVP game?

You need to keep in mind how many players you need to have statistically significant cohorts to make data driven decisions. If you have a PVP game, liquidity is the key for your matchmaking and therefore the UA team needs to spend continuously to provide a certain amount of daily new users to make it work. Because, as we know, if matchmaking doesn’t work, it can influence the retention numbers and overall feel of the game.

Days when Mobile app install (MAI) optimization was the only way to go are gone. While it can drive good quality traffic, it won’t be sufficient in the retention and monetisation stage. When you enter the retention stage, sit down with a data team to identify events in the game (tutorial completion, level 10 achieved, 5 missions played, connect Facebook or share invite) that suggest player engagement and higher quality. Then implement and use these events for optimisation purposes in the App Event Optimisation (AEO) campaigns. Finally, as mentioned before, running AEO Purchase campaigns in the monetisation stage will provide necessary p(l)ayers to evaluate monetisation KPIs of your game.

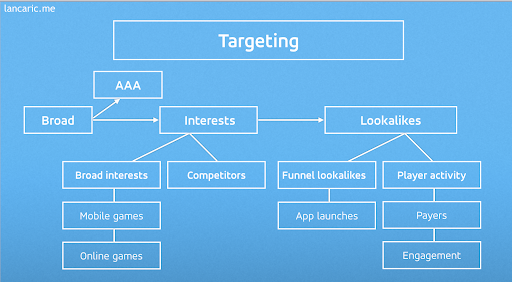

Starting with broad campaigns using Facebook regular campaigns or Automated App Ads campaigns, continuously narrowing down the targeting to individual interests or lookalikes later down the road, depending on the results.

Diversifying the UA portfolio is one of the most important parts of the marketing activities in the monetisation stage. Different channels yield different LTV curves. Understanding this prior to global launch is crucial for setting up the global launch strategy. The same applies to Android vs iOS campaigns. While Google Ads is an important part of Android UA activities, for iOS it sucks balls. On the other hand, Facebook could work well for iOS, but not on Android. Be sure to test multiple ad networks before going global. If your soft launch budget doesn’t allow it, run Facebook, Google and Unity as minimum viable UA portfolio.

Challenges

Almost nothing goes according to plan. CPIs are increasing rapidly because you have been in the soft launch in limited countries for too long – how can you tackle increasing CPIs? Find out in my creative framework here! Other challenges have already been covered above. Soft launch is not easy, but you can make it!

A successful soft launch is the best way to optimise your game for global launch. There is no doubt. Soft-launching allows developers to collect data, identify bugs and receive early feedback from players. But the soft launch period isn’t just for testing the product. UA teams should be using this time period to test and optimise every aspect of marketing.

There is no optimal soft launch strategy for everybody, but by now you should know how to do it. The fun starts with the global launch, but that is something we can discuss next time.

Helping you stay 2.5 steps ahead of the games industry. Don't be too serious, except about UA.

Subscribe to my Brutally Honest newsletter!